The 2025 monohydrate

citric acid market grapples with volatile feedstock costs and surging demand across high-value sectors, leveraging its "natural origin" and functional versatility.

· Feedstock Challenges: Corn, accounting for over 70% of production costs, trades at $437.87/bushel in December 2025, up 2.67% YoY amid tight U.S. stocks and reduced Ukrainian exports . Sulfuric acid prices have spiked 38.5% month-on-month, pushing theoretical production costs to $720/ton and squeezing margins .

· Green Demand Surge: EU phosphate detergent bans drive 12% YoY growth in industrial-grade demand. The global pharmaceutical-grade market, valued at $1.12 billion in 2025, expands at 10.1% CAGR for drug stabilizers and excipients . Food-grade products retain 58% of consumption amid clean-label trends .

China holds 78.6% of global capacity (220 million tons/year), with monohydrate accounting for 85% of total citric acid output .

・Capacity Restructuring: Small polluting plants in Shandong/Jiangsu are phased out under China’s 15% energy reduction targets. Leading firms like Shandong Lemon 生化 boost capacity by 5.3% CAGR via green upgrades .

· Tech Innovations: Domestic manufacturers adopt "two-stage fermentation + membrane separation," lifting extraction rates to 92% and cutting energy use by 28% . International players like Jungbunzlauer focus on high-value grades to compete .

Monohydrate citric acid penetrates ESG-aligned sectors, creating new growth drivers:

Biodegradable Plastics: Used as PLA 助剂,it supports China’s $12.8 billion PHA industry, driving 15% YoY industrial demand .

Pharmaceuticals: USP-grade material is critical for mRNA vaccine stabilizers and oncology formulations .

New Energy: Serves as a 络合剂 in lithium battery precursor production, tapping into EV demand .

· Domestic Standards: Upcoming 2026 national standards mandate ≥99.5% purity and ≤1.0% moisture, raising entry barriers .

· International Trade: RCEP boosts China’s exports (70% of global trade) to ASEAN by 6% YoY. EU traceability rules hike compliance costs for corn-based supplies .

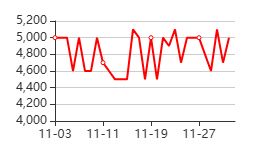

Regional prices reflect cost and demand shifts:

· China: Food-grade FOB $1,100–1,250/ton, up 7% YoY due to energy taxes .

· Europe: Pharma-grade CIF €1,500+/ton, supported by green premiums .

Forecast: The market grows at 5.5% CAGR to $4.5 billion by 2032 . Firms must secure corn supply chains, upgrade to high-purity production, and align with ESG regulations to compete.

![1764901968212956.png]()

![1764901969659616.png]()